At this time of the year, most avid golfers are not only regularly hitting the links, but also paying close attention to the PGA Tour Rankings and other televised events. Indeed, their eyes will be glued to the television from June 16 to June 19 watching the U.S. Open, one of the sport’s four majors.

One of the names to almost always come up when discussing who will take the top prize at one of these majors is Phil Mickelson. That’s because Mickelson, 45, has won 42 tour events over his storied career — including five majors — and was inducted into the World Golf Hall of Fame back in 2011. Interestingly enough, the golfer, who took home an estimated $51 million in 2015, was recently embroiled in an insider trading case.

What exactly did this insider trading case involve?

According to the Securities and Exchange Commission and the Department of Justice, Mickelson was associated with a professional gambler who, in turn, was associated with a former board member at a major food producer.

According to various civil and criminal complaints, the board member would surreptitiously contact the gambler with inside information about pending corporate moves, enabling the two of them to make tens of millions of dollars from 2008 to 2012.

The gambler allegedly contacted Mickelson, who owed him money, back in 2012, advising him to make a particular stock move that could prove lucrative. The SEC claims that Mickelson heeded the advice and made a one-time profit of $931,000, at least some of which went to the gambler.

Is Mickelson facing criminal charges then?

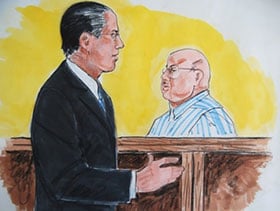

Only the board member and the gambler are facing criminal charges. Mickelson was named as a relief defendant in a civil suit filed by the SEC, meaning he was accused of profiting from illegal activity, but not actually partaking in it. In fact, his legal problems came to an end last week after he agreed to repay the $931,000.

How did he manage to escape criminal liability?

According to legal experts, the lack of criminal charges against the golf great can be attributed to a 2014 appellate decision that made it considerably more difficult to prosecute those who benefit from insider trading.

Specifically, criminal charges can only be leveled where there’s evidence showing that they had first-hand knowledge of every person’s role in the activity and how the inside information was secured.

In Mickelson’s case, they theorize that he couldn’t be charged with violating securities laws given that while he was tipped off, he didn’t know from where or whom the inside information had originated.

It’s worth noting that even though Mickelson appears to be in the clear from a legal perspective, the PGA Tour is currently investigating whether he violated some of the player handbook’s prohibitions on gambling.

If you are under investigation or have been charged with any sort of white collar crime, consider speaking with an experienced legal professional as soon as possible as these are complex criminal cases that require painstaking preparation and a thorough investigation.